Over the summer, I had the privilege to work with some of the smartest investors in NYC at Primary Venture Partners. Somehow the stars aligned and Ben Sun, Founding General Partner and investor in Coupang, mentored me. YES, y’all my ancestors are out here fighting for me!!! For an hour each week, we would discuss my investment thesis, and he would challenge me to grow as an aspiring investor.

During one of our weekly meetings, I told him that I was fascinated by all the fintech deals I was seeing at Primary and that I wanted to become a “FinTech Investor,” to which he responded, “Well then, you should probably learn about the space.” **** Mic Drop

That conversation, though simple, became extremely impactful and charted my course to learn all that I can about what fintech is and its universe. As I spoke to folks within my VC network, it became apparent that I’m not alone in my conquest to navigate this fintech terrain, so I’ve decided to take my community along for the ride so we could learn together!

In this piece, I’ll demystify fintech and break down what I’ve learned, talk about the VC Unleashed FinTech Breakdown Series that this journey bore, and share insights learned from my conversation with Matthieu Hafemeist, Partner at a16z.

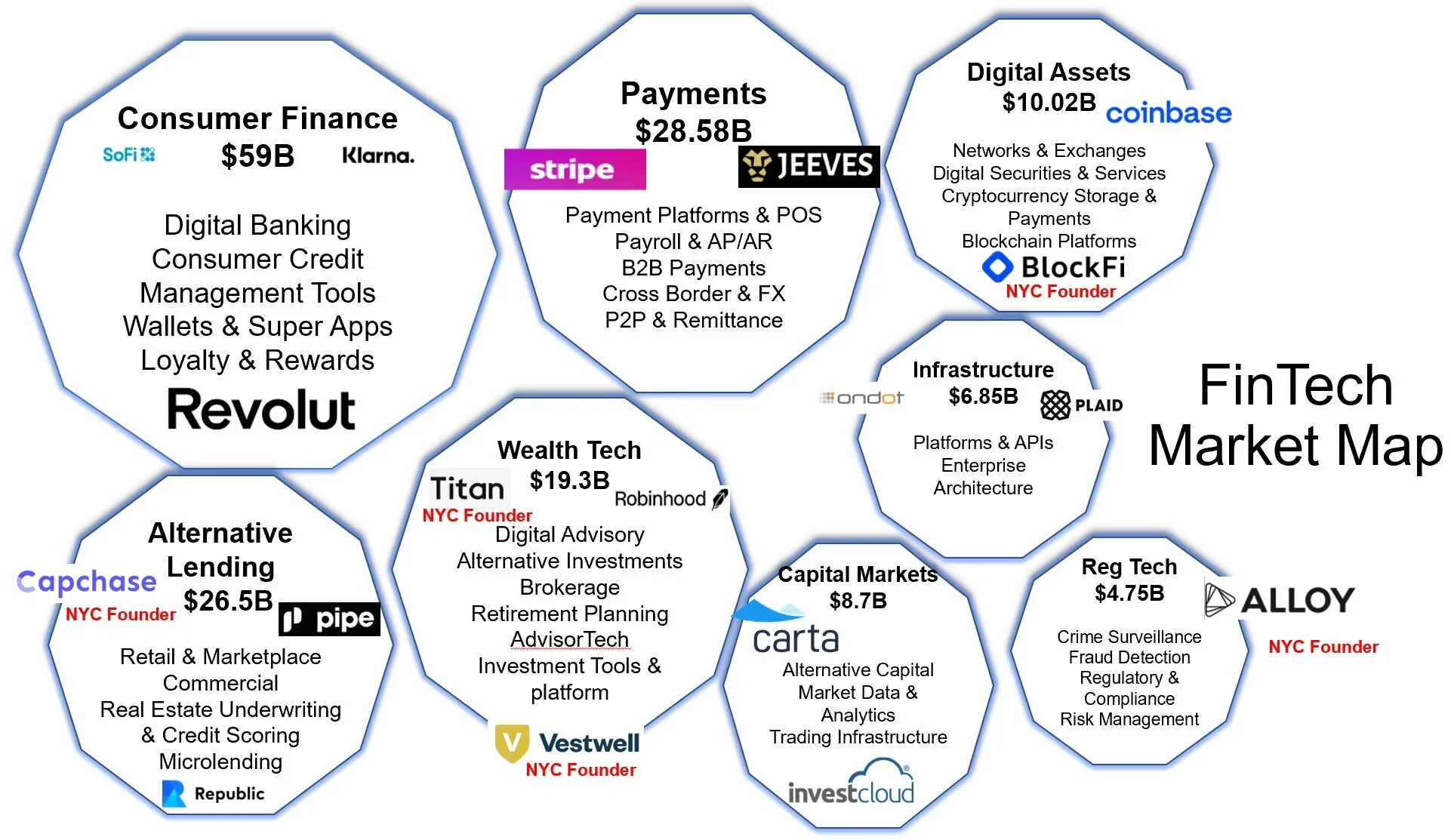

So far I’ve learned that the fintech market is vast and embedded in everything (the folks at a16z know that well) and to help boil down the market into digestible subsectors I created a fintech market map with top companies in the sectors and the number of dollars that poured in Q1 of 2021. Thanks to the folks at Pitchbook for their help here.

To dig a little deeper into the market map, I picked my three favorite sectors of the market to talk about and discuss some of the companies in the space.

Consumer Finance has been the most visible and mainstream part of fintech and saw the most venture investment this last year. It basically boils down to companies that enable consumer financial empowerment from digital banking aka neobanks like SoFi, Ally Bank, and Revolut that are accelerating the banking revolution to consumer credit and enablement like Klarna and Affirm leading the buy-now-pay-later movement. One thing to note is that much of the innovation in consumer finance has been unlocked due to the advancements in IT infrastructure in fintech.

Payments is the second largest sector that received venture investments. At the crux of the pain point is moving money from one identity to another. Companies in this sector are usually B2B business models like Stripes that allow money from credit cards or banks to be transferred to the online shoe store you just bought your black knee high boots from or like Jeeves, a LatAm based company that is solving cross border and FX payment problems. Unlike consumer finance, you see a mix of companies building on top of the other backend infrastructure capabilities and creating infrastructure solutions like Stripes.

Alternative Lending are companies that enable you to secure funds without having to go through traditional banks. A very well-known player in the sector is Republic, a crowdfunding platform that has enabled startups to raise capital from individuals opening streams of capital for growth. One of my favorites, Capchase (also an NYC company) that upfronts cash for SaaS companies based on their accounts receivables. I was mind blown when I started to dig into this company and how they can unlock cash for businesses to grow.

So after I created this market map, I figured that it would be helpful to identify the most prominent fintech investors and ask them if they’d be willing to chat with me.

These investors were extremely receptive to speak with me. So I figured if they’re willing to speak with me, a bright-eyed, bushy-tailed MBA, why not instead speak with 50 MBAs??? This idea gave rise to the FinTech Breakdown Series with VC Unleashed; conversations with top investors in fintech to understand the space better but more importantly to get into the psyche of their investment framework.

I kicked off the series with Matthieu Hafemeist, former Partner at a16z and now Head of Growth at Jeeves, who provided an overview of the space and a great perspective from how a16z, one of the most powerful VC funds in the world and consistent market maker, thinks about fintech opportunities.

Here are some highlights from our conversation:

Matt’s Take on the History of FinTech: The industry has evolved from having finance professionals build the space to now having techies lead the next generation of solutions. Think of a shift from your very serious insurance professionals to a new world led by the likes of the Lemonades of the industry. My unsolicited opinion (as a burgeoning finance bro) is that the best kind of fintech founder is one with deep domain expertise and a technical team building alongside her like Sallie Krawcheck who was the CEO of Merrill Lynch Wealth Management and Smith Barney before going on to start Ellevest, a digital financial advisor for women.

FinTech Verticals Explained: FinTech is fun in that it can dive deep AND / OR go vast. According to Matt, the fintech market is not about one winner but instead of many verticalized and sub verticalized players.

One of my favorite examples of a company vertical that also started with a niche serviceoffering is Lemonade, an insuratech company that specialized in renter’s insurance as a wedge into the market. After getting its footing in the market, it has grown its service offering to home and pet insurance (yes, the pet industry is a real one).

The Future of FinTech According to Matt:

1) Emerging Markets in Fintech are HOTT! There has been a ton of capital deployed in LatAm. The region is seen as a huge opportunity to leverage fintech to tackle challenges with problems like cross-border payments and increasing access to banking. Matt’s not wrong either. The market validates this thesis, and according to Pitchbook data in 2021, over $12B in capital has been deployed in LatAm compared to $4.9B in 2019. Additionally, the titans, including a16z and Sequoia, are pushing capital and resources into the area. SoftBank is also doubling down on LatAm as their first fund in the region has exceeded expectations.

2) Embedded Fintech is the future (and the now) of fintech. This is a simple concept that was a bit confusing to me at the beginning but now I got it! Embedded Fintech means adding fintech to everything in every industry. Examples of this include paying via the Uber app and having Klarna or Afterpay at every Shein checkout cart order. It’s literally everywhere, and you don’t realize it. A16z has been making bets on embedded finance for a while. Check out their “Why Every Company Will Be a Fintech Company” with Angela Strange, GP at a16z and a long time fintech investor for more.

What Matt is obsessed with: The New Age of Ownership basically democratizing and reimagining how we think about ownership. This is in line with the emergence of alternative investments. Think of the NTFs as the currency for digital collectibles as a new way to monetize your work or getting stock back instead of cash back with Stash when you make purchases.

Next I’ll dive into my conversation with the GOAT B2B Guru, Elliott Robinson, Partner at Bessemer Venture Partners.

Also we do have another VC Unleashed FinTech Breakdown Series coming up with one of my old bosses Jason Shuman on the banking revolution where we will dive into the role that neobanks are playing in accelerating change in the industry and Primary Venture Partner’s investment in Lili.

Register HERE - https://www.eventbrite.com/e/fintech-breakdown-series-jason-shuman-the-banking-revolution-tickets-175229404867

Lastly, my ask as I continue this series: Comment below on

● Recommendations of who I should speak to

● Interesting Topics to dive into

● Investors based in Europe doing some cool things